Budgeting isn’t simple. Every dollar counts and often it can seem like there’s not enough money to pay for rent, food, or even expenses. But knowing ways of how to budget money on low income will aid you in staying in control and make use of your money more efficiently. This simple guide was created for those who wish to reduce their expenses and be less stressed and help their money last longer, even when they earn less.

Learn how to keep track of your expenses, create plans, and reduce your spending a bit each time. If you’re employed in at a minimum wage or simply trying to stretch your budget this article provides the best tips to aid you in reaching your goals, even if you’re on an extremely tight budget.

Why Budgeting Is Important When You Have a Low Income

A small amount of money can be a challenge. Small mistakes could result in major issues such as not paying expenses or getting into debt. This is why knowing how to budget your money with the low end of income can help greatly. It helps you use your money in a wise way and to save for the unexpected. Even putting aside a few dollars for an emergency fund by earning only a little income will make you feel more secure.

A lot of families across the USA aren’t able to be able to live comfortably. A report by the U.S. Census Bureau (2023) estimates that more than 37 million people are living in poverty. If you employ effective budgeting strategies for families with low incomes you will be more confident and create plans to live a better lifestyle.

The Hard Parts of Living Paycheck to Paycheck

If you’re living from paycheck to paycheck you feel as if there’s no way to have enough. It’s impossible to save, it’s difficult to take a break, and don’t have time to plan in the near future. If your car is damaged or you receive a surprise bill, everything becomes more difficult. It’s the reason learning to manage money even with a small income is a great way to break this vicious cycle.

The constant worry about finances can cause you to feel depressed or stressed. A budget planner with a low-income income can help you feel more organized and optimistic.

How Budgeting Gives You Control and Confidence

When you create budgets and feel calmer, you are more relaxed. You are aware of how much cash you have and the amount it will need to cover. Even if you’re not earning an enormous amount, having a budget can help you feel in control.

Basic budgeting techniques can help you spend more effectively. You can stop spending money, and begin saving. You can achieve financial goals with a modest income, such as paying off bills or saving up for something extra. As you move forward you will build your confidence and your savings will improve.

Step-by-Step Guide to Budgeting Money on a Low Income

Knowing how to budget the money you earn on a small income is not difficult. First, you must know how much you earn and the amount you are spending. Utilize a budgeting for low income worksheet or an app to keep track of your spending.

Then, record everything you buy in the next 30 days. Each snack you buy, each bus ride — everything. It could be a surprise to discover the places your money is going. This will show you how to begin saving.

Step 1 – Know How Much You Earn and Spend

Begin by writing down all your earnings. This includes your salary as well as any side-jobs or aid by the federal government. Note down your expenses including rent and phone bills and food costs, as well as gas. Then, you’ll be able to figure out how to create a realistic budget for families with low incomes.

Step 2 – Track What You Spend for 30 Days

In one month, you should note down every penny you spend. Keep a journal or use the budgeting software for people with those with low incomes, such as Mint and EveryDollar. This is known as expense tracking in low-income households.

It is possible to spend a total of $60 each month on fast food. This knowledge can help you save. It is the way to learn how to budget your spending when you have a limited income and start to alter your financial habits.

Step 3 – Needs Come Before Wants

If you are struggling to make ends meet it is important to know the distinction between wants and needs. The things you need are food, rent and medical. Needs include things like new clothes or dining out. Concentrate on the need to make a budget-friendly weekly strategy for people with low income.

The 50/30/20 approach is not always the best option for people with low incomes. Spend only on the essential things. This will help you stay in a tight budget, while being able to live comfortably.

Step 4 – Make Small Goals You Can Reach

Begin with a simple target. Each week, save $5 or pay off a small amount. These little victories help you feel a sense of pride. They can help you develop into financial planning with a modest salary incrementally.

A goal can help keep you focused. If you’re looking to save money for a phone or an emergency, record it. That’s how you meet your financial goals even with a small income.

Step 5 – Pick the Budget Method That Works for You

There are a variety of methods to budget. One method is a zero-based budgeting low-income style. This means that you determine the place where each dollar will go.

Another method is using the envelope method. Cash is put into envelopes, such as “Food,” “Rent,” or “Gas.” If your envelope is empty and you have stopped spending, you can stop. This will help you stay on your budget even with a low income.

Smart Tips to Reduce Expenses Without Sacrificing Quality of Life

You can still live your life to the fullest, even when you’re in a financial pinch. All you need is to be innovative and creative. Making savings when you’re on a budget does not mean giving up the enjoyment. Concentrate on small adjustments that will help you save money. Many families utilize low-income money saving strategies to help make their money last longer. The act of saying “no” to some things today means that you can be able to say “yes” to more important items later.

The objective is to live comfortably with less spending. Utilize free tools, get public assistance and make smart purchases. There are ways to save money while still enjoying your time. This is the place where low-cost living strategies can be of the greatest help. Making small changes every day could save you hundreds over the course of time.

Save money on Groceries by meal planning

Before you shop, make a plan for your meal plans. Consider the foods you already have in your home. Create a list and adhere to it. Making a habit of buying in large quantities and cooking at home can help to save money in a hurry. Don’t shop when you’re hungry. It can lead to poor choices. Many families have reduced their food expenses by 25% after doing this. Living a frugal lifestyle for people with low income families typically start at the table.

Lower Bills by Cutting Unused Subscriptions

Examine your credit or bank card statements. Have you been paying for services or apps you haven’t thought of? Eliminate the ones that you don’t use. These types of applications are often not used. Cut down on monthly expenses and income by reducing even one $10 off your subscription. That’s $120 savings in a year.

Find Free or Low-Cost Entertainment

Free events, parks or libraries that are open to the public offer entertainment without spending any money. Have a game night at home or attend local events. There is no need to pay for a fun time. Join Facebook groups or go to the website of your city for ideas on free activities to take part in. Living a frugal lifestyle on a budget is about making the most of the resources your city already offers you.

Use Public Resources (Libraries, Food Pantries, Local Aid)

Libraries offer free books, internet access, and classes. Food pantries allow you to spend less from the grocery store. Local assistance can provide assistance with power bills or school items. Don’t feel guilty about using these. They’re created to assist. Many families rely on them in times of need.

How to Increase Your Income (Even a Little Helps!)

Making more money is equally crucial as saving. There is no need for another job to increase earnings. Small side jobs like hobbies or selling items that you haven’t used for a while can be helpful. Every little bit of extra money can be a big help. This extra money can give you the opportunity to breathe and go towards the achievement of your financial goals despite the basis of a small income. With time, you could be able to make it more substantial.

Think about your skills. Do you have the ability to cook, write, or even organize? Small ideas can lead to significant impact. It’s not about making money quickly, it’s about building momentum by using budget-friendly tips for low income.

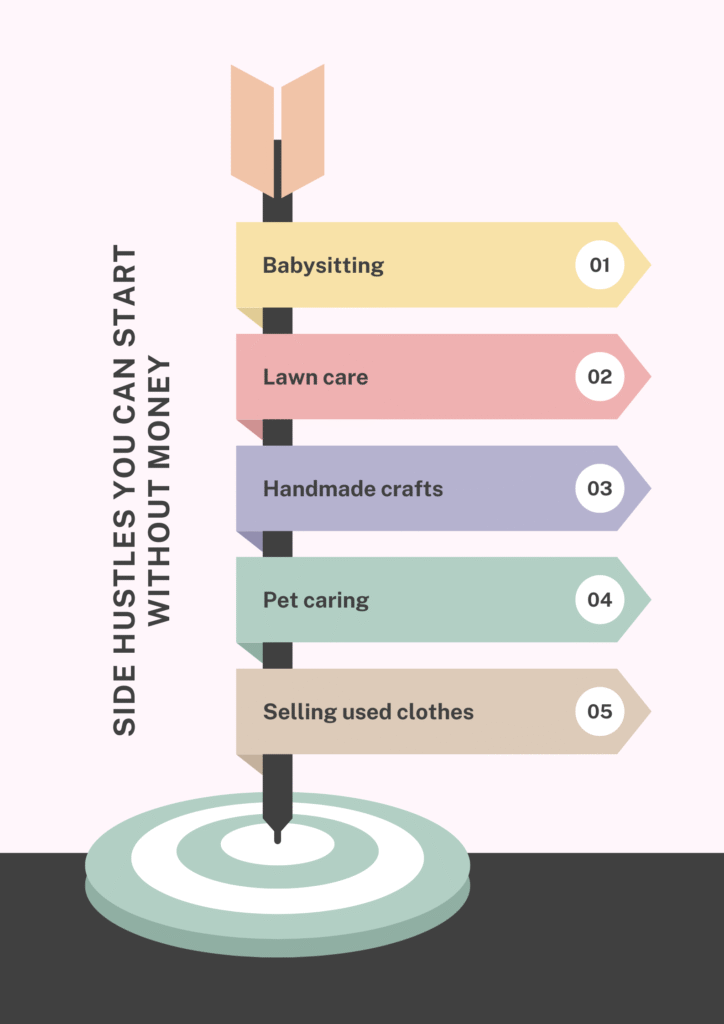

Side Hustles You Can Start Without Money

Offer babysitting, yardwork or even housekeeping. Sell homemade baked goods or crafts. It doesn’t require funds to start, but only the time and effort. These are the easiest ways to start financial management for people who earn little.

Freelancing or Remote Microtasks

Utilize your laptop or smartphone for small-scale online jobs. Consider websites such as Fiverr, Upwork, or Clickworker. These sites pay a small amount in the beginning, but they add to a lot. You can work during free time or weekends. This is great for parents with busy schedules or students.

Selling Unused Items or Offering Local Services

Look around your home. Do you have excess clothes, tools or toys? Sell them on the internet. You can also offer assistance to your neighbors. Things like painting, moving or organizing can be lucrative and are sought after.

Tools and Apps to Aid in Budgeting for Low Incomes

Technology can help you budget more efficiently. A lot of applications are free and simple to use. They monitor your spending, income and expenses. They notify you when your bills have been paid or you spend more than you earned. Make use of these tools to adhere to your budget and plan for your weekly income. Select apps that are compatible with your lifestyle.

Some people prefer paper. This is fine as well. Trackers printed on paper can help you track your improvement. Keep one on your fridge or inside your wallet. These tools help you stay on track and can help you figure out the process of sticking to a budget even with a low income.

Free Budgeting Apps (Mint, EveryDollar, Goodbudget)

These apps are among the best budgeting software for those with low income families. Mint connects to your bank account and displays your entire financial picture. EveryDollar is easy to use and assists to plan your finances. Goodbudget makes envelopes using digital technology. Test them out and choose the ones you like.

Printable Budget Trackers and Spreadsheets

Make use of a budgeting worksheet with a low income to view your financials. Google Sheets has free budget templates. There are also monthly tracking templates available from financial blogs. Note your expenses every day to keep you on track.

Common Budgeting Mistakes to Avoid

Mistakes happen. However, some mistakes are more costly than others. Knowing what to avoid is as crucial as learning how to make the right choice. Avoiding budgeting errors include not paying attention to small expenditures or quitting too quickly.

Another error is to set goals that are too large. Then you feel like you failed. Make it simple. A monthly budget that is low in salary can only be effective in the event that it’s achievable. You can always increase it over time.

Ignoring Small Expenses That Add Up

$3 coffees Fast food for $5, $7 delivery charges. They may seem like a small amount, but they can add up quickly. Monitor them and check the total.

Giving Up After One Bad Month

One bad month doesn’t mean failure. Everyone makes mistakes. The trick is to learn from your mistakes. Budgeting is akin to learning to ride a bicycle. Then, you fall, and get up and go back on the bicycle.

Conclusion

A budgeting process is a process. One way to stay focused is to recognize small victories. Have you saved the equivalent of $10 this week? It’s an achievement. You paid off a debt earlier? Celebrate. Small victories like these help you stay motivated as they remind you of the fact that your work is important. They can help build habits that will keep you on track with your budget and low salary plan.

Another great habit is to check your budget each week. Choose a time – Sunday evening is a good choice. Then, you can review your budget. Modify your plan as needed. Then, you can use visual reminders. Put your goals on the refrigerator. Write it down on your calendar. Keep your focus on your mind. These tools can help to keep your focus and remind you of how to live financially on a low income is feasible by focusing on the right attitude and actions.