The process of saving for a house is not easy. Making money for an apartment with an individual parent can be extremely difficult. However, here’s the reality: you are able to do it. It requires time, planning and a lot of patience. Parents just like you have been there. In this house buying checklist for parents with children will guide you through how to accomplish your final goal.

Learn about budgeting for How to Save for a House as a Single Parent and how to handle stress from money. It’s not just advice, it’s an actual plan. Let’s take a look at ways one parent can have their own properties and still earn only a modest income.

Why It’s Harder for Single Parents to Save for a House

As a parent on your own is being able to do everything. You pay your bills, look after your children, and try to prepare for the future. This is why the process of saving for a mortgage when you’re an adult with a child requires more effort. It’s not impossible. It’s just a matter of following the correct steps.

Many parents face the challenges of poverty, no support from a partner, or increasing rent. These are real issues. But you can find inexpensive housing alternatives for families with a single income. Even if the pace is slow but you can still achieve progress. Be persistent and don’t give up.

The Unique Financial Challenges of Single Parenthood

Single parents typically make less. This means making money with one income is difficult. Children require food, clothing, and school supplies, and emergencies could occur. Bills are piling up. It’s stressful.

The Importance of Financial Planning Early

Planning your finances as a single parent is vital. It allows you to take charge of your finances. You’ll no longer have to make up your mind any more. You’ll know exactly what you can spend and what you’ll require to make changes.

The earlier you begin, the more efficient. Your savings will have more time to increase. Small steps will help you save money for an individual down payment. Gradually, you’ll be there.

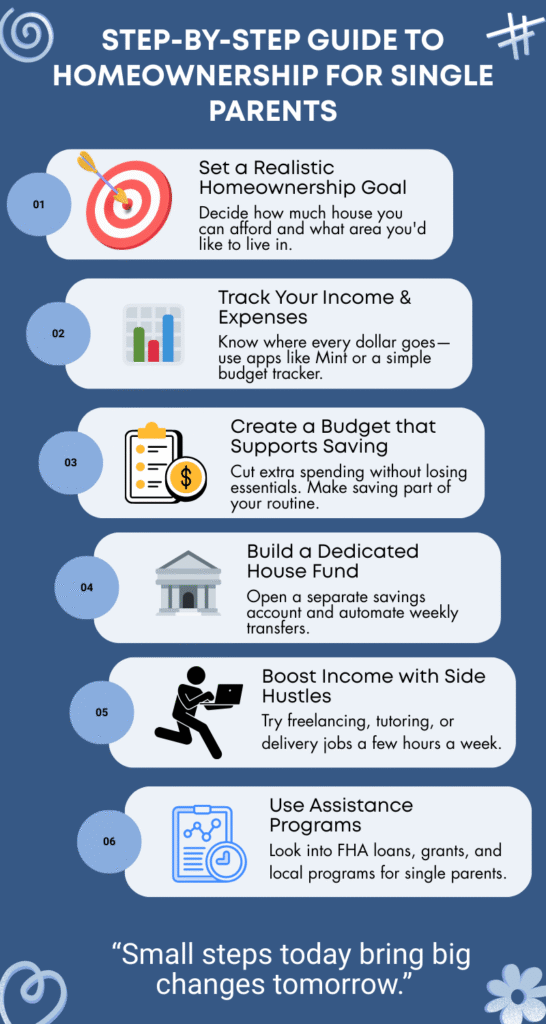

Set a Realistic Goal for Homeownership

It is essential to have a goal in mind. Without one, it is easy to be confused. Consider where you would like to reside and which type of house you’d like to have. Ask yourself: How much should one parent with a single child save up for the purchase of a home? The answer will depend on your location as well as how much you earn and what assistance you can get.

Certain areas have less expensive homes. Other areas are more expensive. This is why setting a goal can help. You’ll be able to see how close you are to having your own home. You’ll be able to go from fantasizing to being.

Understand How Much House You Can Afford

The lenders say that your home’s costs should not exceed 30% of your earnings. This includes mortgage tax, insurance, and taxes. Make sure you calculate this before you begin shopping.

These are only estimates. Use online calculators or talk to a lending officer.

Know the Upfront Costs: Down Payment, Closing Costs, Fees

There is no need to pay 20% down. Certain programs allow you to pay only 3%. Take a look at mortgages for low-income parents who are single.

Costs for closing can range from between 2% and 5%t of the house’s cost. There will also be a need for funds for loan inspections and costs. Knowing the total cost can help you plan your savings plan for your home, especially if that is suitable for dads who are single as well as moms.

Create a Budget That Supports Your Savings Plan

A budget that is well thought out can help greatly. It will show where your money is going. So you can make adjustments and save the cost of a home.

Once you’ve figured out what you have, you will feel more in control. It might be difficult initially, but it’s worth it. In time, you’ll have a robust home saving strategy that is suitable for moms who are single as well as dads.

Track Monthly Income and Expenses

Note down your earnings and expenditures. Even the smallest things matter. Start with this:

Understanding where your money is going can help you make better decisions. Monitoring is the first step.

Cut Unnecessary Spending Without Sacrificing Essentials

Reducing your expenses doesn’t mean you have to cut out the enjoyment. Take a look at what you are spending your money on. Find out if it is helping the goal.

You can cancel subscriptions that are not being used such as fast food, subscriptions to magazines or even extra shopping. This money will help you build your savings as a single parent. These are fantastic budgeting strategies for single parents who are buying an apartment.

Use Budgeting Apps Tailored for Single Parents

Apps can simplify things. Tools such as YNAB, Mint, and GoodBudget will help keep you on the right track. They monitor your spending, display habits and provide notifications.

These are fantastic budgeting strategies for single moms. They can even help you to save money. Let tech help you.

Build a Dedicated House Savings Fund

A housing fund is much more than just savings. It’s your goal. Set up a separate account for your home. So you don’t accidentally use it. Create a habit of saving. Every dollar saved will get you closer to achieving your desired goal.

Choose the Right High-Yield Savings Account or Money Market

All accounts are not equal. Certain offer you more in return. Find the best savings account to fund your home purchases that have no charges and a higher rate of interest. Credit unions and banks online generally have options that are good. A better rate helps your money grow.

Set Up Automatic Transfers to Stay Consistent

Your bank should transfer funds each week into your home account. A little bit of money a week can help. This will build up your home deposit savings tips. Automated saving keeps you on the right track even when you’re busy.

Use Visual Tools or Savings Charts to Stay Motivated

Create your own chart. Colour boxes while you save. You can also use an app to track your improvement. Each little win counts. The idea of seeing your savings grow can help keep you motivated. Visual tools keep your dream alive.

Earn More Money with Side Hustles or part-time jobs

In some cases, price reductions aren’t enough. You might require more money. Explore different job options that are suitable for parents with children to help you reach your goals.

Just a few hours per week can be a huge help.

Flexible Job Ideas for Single Parents

Jobs such as writing or driving to applications, tutoring, or taking care of pets are excellent. They are flexible to fit into your schedule. This type of job can generate the equivalent of $200-$600 a month to help you with your sole parenting and the home ownership journey. This is an enormous increase.

How do you balance extra work with Parenting responsibilities?

Your time is precious. Use a calendar. Select the days of the week to work on side projects. Invite family members or friends to assist with your children. Remember to take a break. Being tired will not aid in your success. Balance is crucial to success.

Take Advantage of Grants, Assistance & First-Time Buyer Programs

There’s no need to be alone. There is help available. It is possible to get government grants for parents who are single as well as nonprofit organizations and local programs.

These may provide cash for down help with payments for parents who are single or help you lower the cost of your loan.

Government Grants & Nonprofits That Help Single Parents

Organizations such as HUD as well as Habitat for Humanity offer help. Your state might have programs as well. They make up the first-time homebuyer program for mothers who are single or dads. These programs make purchasing a home easier.

FHA Loans and Other First-Time Buyer Programs Explained

FHA, USDA, and VA loans require less down. They also have less credit scores. These are great mortgage advice for single income earners. Contact the local bank or a lender who can aid.

Take care of debt prior to taking on a mortgage

It makes it harder. When you pay it off, you get more money and improve your credit rating. Both are essential to be considered when purchasing a house as the sole mother or father.

How Credit Score Affects Your Mortgage Rate

Better credit means lower loan rates. Here’s a quick look:

Lower rates translate to smaller monthly payments. Also, you should start working to get credit as one parent today.

Practical Steps to Pay Off Credit Card or Student Loan Debt

Start by taking on small loans. You should pay more than your minimum. Request lower rates. Look into debt programs. Every debt you pay off helps you get closer to the purchase of your first house as one parent. You’ll be able to live more freely.

Tips to Stay Motivated on Your Saving Journey

Saving requires time. It’s not easy to feel lonely. However, you’re doing something incredible. Keep up the good work. Keep track of your progression. Be proud of your achievements. Meet with other people who are also saving.

Celebrate Milestones–Big or Small

Saved $500? This is an accomplishment! Enjoy a simple celebration like the theatre or a meal you love. This is what keeps you enthusiastic about what you want to achieve in your financial goals for single parents.

Join Online Groups or Support Networks for Single Parents Saving for Homes

There are online forums for first-time home buyers’ assistance for parents who are single. Join them. Tell your story. Ask questions. The ability to talk with others can be helpful in tough times. It can make a difference.

Conclusion

Finding a mortgage with a single income may be a challenge however it is possible with the right approach. Establish your own budget, reduce unnecessary costs, set clearly defined savings goals, and pursue aid programs for housing to help you get closer to achieving homeownership. Keep in mind that your journey will take some time, but every tiny step counts. Being consistent and focusing is the key to making your desire to own a home become a reality.

If you’ve been thinking about how to save for a house as a single parent, Begin by keeping track of your expenses and figuring out clever strategies to cut costs. Don’t be afraid to contact local support groups or financial advisors to help in the process.

What’s been your biggest struggle with how to save for a house as a single parent? Share your story or suggestions in the comments section–we’d like to hear from you!