Are you tired of watching your hard-earned money disappear too quickly? Frugal living tips to save money can help you take control of your finances without sacrificing your happiness.

In this article, you’ll find smart, simple ways to cut costs, stretch your income, and enjoy life. Whether you’re saving for a big goal or managing your monthly finances, these practical ideas can make a real difference.

Ready to learn how small changes can lead to significant savings? Keep reading to see powerful yet easy strategies you can start using today!

What Is Frugal Living and Why Is It Important?

What Does It Mean to Live Frugally?

Living frugally means being smart with your money. It doesn’t mean being cheap. It means you spend money only on things that really matter. I stopped eating out all the time and started cooking at home. It saved me over $100 every month!

Here are some easy ways to start living frugally:

- Cook meals at home using simple, cheap ingredients.

- Buy used things instead of new ones.

- Turn off lights and unplug gadgets when you don’t use them.

These little habits help you save money without giving up what you need.

Why Is Living Frugally Good for You?

You can save money by being frugal, but there are other benefits as well. It helps you feel less stressed. You can save money for essential things like trips or emergencies. Many families use smart money tips to buy groceries and pay bills without worry.

When you save money every day, you get:

- Less impulse buying

- Better money habits

- Extra cash for fun or emergencies

Living frugally means having enough money and using it well.

Is Living Frugally the Same as Being Cheap?

No way! Being cheap means only buying the most affordable stuff, even if it breaks fast. Frugal means buying good things that last. I bought a warm coat on sale once. It’s lasted five years! That’s a real saving.

You can also save money on food by buying in bulk or choosing in-season items. The key is to spend smartly, not cheaply.

Next, I’ll share some of the best frugal living hacks you can try.

How to Start Living Frugally Today

Step-by-step guide to adopting a frugal mindset

Living frugally starts with a shift in how you view money. Instead of thinking about what you can’t buy, focus on making the most of what you already have. This mindset helps create smart, frugal habits for beginners.

Here’s how to begin:

- List your needs vs. wants — This helps you avoid emotional spending.

- Set small money goals — Like saving $5 daily (an example of easy ways to save money daily).

- Celebrate low-cost wins — I recently canceled a streaming service and used the library’s free movie rental, saving $15 a month!

Over time, these habits build a stronger, budget-friendly lifestyle without feeling restrictive.

How to identify wasteful spending habits

Next, examine where your money goes. Common areas include:

- Unused subscriptions

- Frequent takeout meals

- Impulse online shopping

Use this checklist to highlight what to cut. Doing this helps you cut expenses without sacrificing quality.

Tip: Use a weekly spending diary to find hidden costs and improve your frugal grocery shopping ideas.

Why tracking your expenses is essential

Tracking every expense—even small ones—keeps your budget on track. Use free apps or spreadsheets. This habit supports affordable meal planning on a budget and money-saving tips for families.

By following these simple steps, you’ll start to live more cheaply while still enjoying life.

Frugal Lifestyle Choices That Make a Big Impact

Living a frugal life doesn’t mean living without fun or comfort. It just means spending money in smart ways. You don’t have to feel poor. You just need to make better choices.

These smart frugal habits for beginners can help you cut expenses without losing quality.

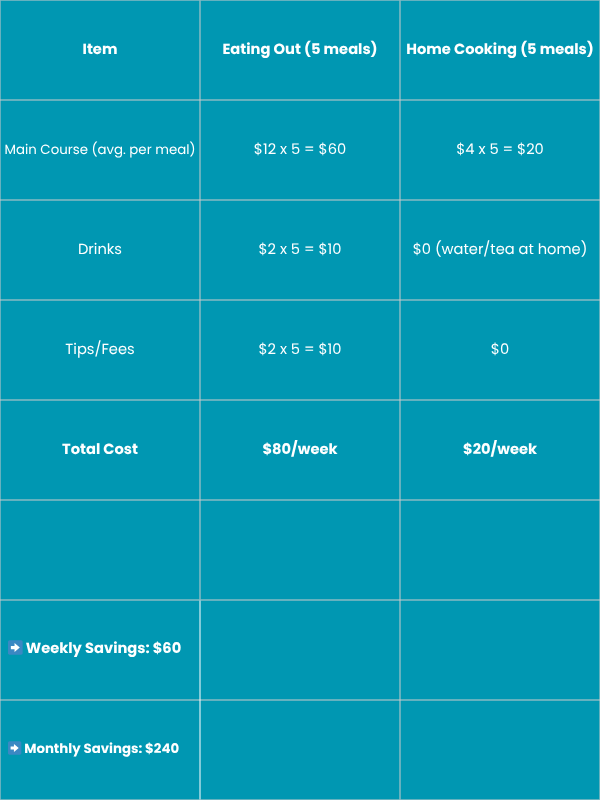

Is Cooking at Home Cheaper Than Eating Out?

Yes! Cooking at home is one of the best frugal living hacks. I started cooking meals on Sundays. Just by skipping takeout, I noticed I saved over $150 every month.

Here’s why cooking at home helps you save:

- You can buy food in bulk using frugal grocery shopping ideas

- Leftovers can be used for lunch the next day

- You avoid tips, delivery fees, and random snack orders

Quick Tip:

Try affordable meal planning on a budget. Use the same ingredients (like rice, beans, or chicken) to make five different meals.

Cost Comparison: Home Cooking vs. Eating Out (Weekly)

How to Save Money by Embracing DIY Culture

Doing things yourself is a great way to save. These are simple budget-friendly lifestyle tips anyone can follow. I fixed a leaky faucet with a $4 kit. A plumber would’ve charged $75!

You can also:

- Make homemade cleaners

- Decorate your home with DIY crafts

- Fix small things instead of replacing them

This is perfect for a frugal living idea for minimalists.

Best Tips for Thrifting and Buying Second-Hand

Buying used items is a smart way to live cheaply and save money.

It’s fun, too!

Here are my favorite tips:

- Shop off-season for cheaper prices

- Look for good furniture on Facebook Marketplace

- Join “Buy Nothing” groups and give or get free stuff

This helps the planet, saves money, and supports a simple, frugal lifestyle.

How to Live Frugally with a Family

Money-Saving Ideas for Parents

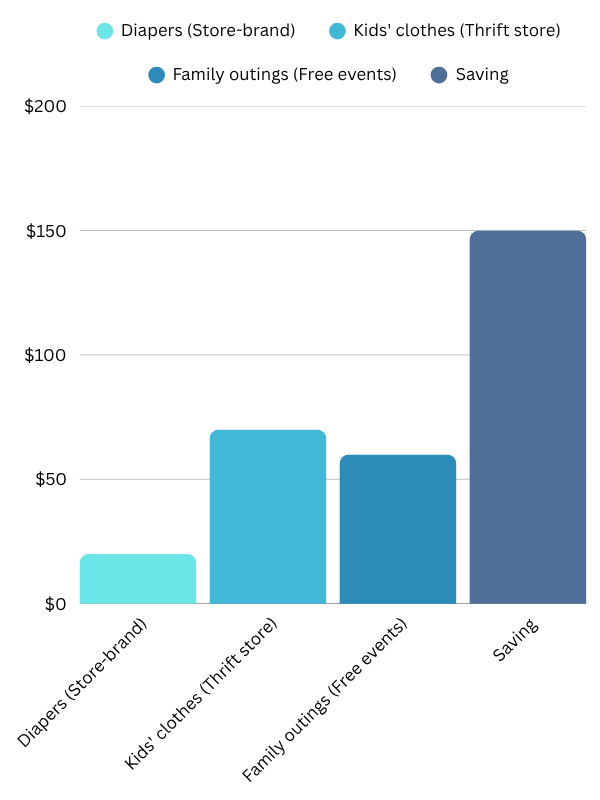

Living frugally as a parent doesn’t mean saying no to everything—it means choosing what truly matters. By using simple budget-friendly lifestyle tips, you can stretch your income without sacrificing family needs.

Here are easy ways to save money daily as a parent:

- Buy second hand: Clothes, toys, and even school supplies are often much cheaper at thrift stores or online marketplaces.

- Meal plan weekly: This helps avoid last-minute takeout and supports affordable meal planning on a budget.

- Create a budget binder: Track monthly bills and spending goals. It helps manage expenses and build savings.

I switched from buying packaged snacks to making homemade granola bars. It saved me $25 a month and was healthier for my kids.

Also, cut expenses without sacrificing quality by joining parent groups on Facebook. Many offer free baby gear, clothes, and playdate ideas that are either free or cheap.

Here’s a quick comparison chart for monthly cost savings:

Next, let’s explore some frugal tips for raising kids on a budget that help long-term.

Frugal Tips for Saving Money Long-Term

Build an Emergency Fund with Small Savings

Want to be ready for surprise costs? For example, if your bike breaks or a pet gets sick, Then you need an emergency fund!

You don’t have to save a lot at once. Just $1 or $2 a day adds up. In a few months, you could have a few hundred dollars saved.

Easy ways to save money daily:

- Use cashback apps for groceries

- Cancel subscriptions you don’t use

- Cook meals at home instead of eating out

I started saving by rounding up all my purchases. If I spent $4.25, I’d save the extra $0.75. In six months, I saved over $300 in a jar—without stress!

Emergency Fund Growth Table:

Next, let’s see how living with less stuff helps you save even more.

Why Minimalism and Frugality Go Hand-in-Hand

Minimalism means keeping life simple. You buy and keep only what you really need. That’s a smart way to save money.

Frugal living and minimalism work great together. When you stop buying things you don’t use, you save more and feel less stress.

Simple tips to live cheaper:

- Keep things you use often

- Say no to impulse shopping

- Use one item for many things (like a good jacket for all seasons)

I used to buy new clothes every season. Now, I wear simple outfits that last all year, cutting my clothing costs in half!

Living with less doesn’t mean missing out. It means spending wisely—and feeling good about it.

Next, let’s discuss growing your money with small, smart investments.

How to Invest Wisely While Living Frugally

You don’t need a lot of money to start investing. Even living on a budget, you can still grow your savings.Use part of your saved money to start small.

Smart frugal investing tips:

- Try low-cost index funds

- Use beginner-friendly apps

- Set up auto-transfers from your budget

My friend started investing just $20 a month with an app. After 3 years, she had over $900—without even noticing it grow!

The key is to start small and be consistent. Frugal habits help you save today and build a better future.

Common Frugal Living Mistakes to Avoid

Saving money is a smart goal. But sometimes, people go too far. That can lead to mistakes.

Let’s look at what to avoid when trying to live a frugal life.

Why Saving Too Much Can Be a Problem

Trying to save every single penny might sound smart. But it can backfire.

One time, I bought the cheapest shoes I could find. They looked fine, but they broke in just two weeks. I had to buy another pair. I spent more money than if I had just bought better shoes the first time.

So remember:

Cheap isn’t always better.

Here are some mistakes to avoid:

- Skipping doctor visits to save money

- Buying poor-quality items that don’t last

- Saying no to all fun things, like a movie or outing

Saving money is good—but don’t go overboard. Find a balance between saving and living.

How to Avoid Burnout While Budgeting

Saving every day can feel hard. You might feel tired, bored, or even stressed.

Try these simple ideas to make it easier:

- Plan easy meals a few times a week

- Use cash when shopping so you don’t overspend

- Have fun “no-spend” family nights—like board games or movie marathons at home

Money-saving tips for families work better when everyone helps. Make it a team effort!

Don’t Trade Quality for Cheap Prices

Saving money doesn’t mean buying the lowest-price item every time. Sometimes, spending a little more to get something that lasts is better.

Here are some smart frugal habits for beginners:

- Look for sales on good-quality items

- Buy in bulk when prices are low

- Use store apps or coupons to save more

Good frugal living means being smart, not just cheap. You can still live cheaply and save money—without giving up what matters most.

Conclusion

Frugal living means being smart with your money. It’s not about saying “no” to everything. It’s about making better choices.

When you learn how to make a monthly budget for beginners, you can save money without feeling stressed. It’s like giving your money a job.

Think small savings don’t matter? Think again! Even saving a little—like $5 a week—can grow over time. That’s $20 a month or $240 a year!

These small steps make a big difference. When you track your money, you stay in control.

A simple budget can help you see where your money goes. It shows you where to cut back and where you can save more.

Saving money can feel hard sometimes. That’s okay! Everyone struggles now and then.

Here are a few tips to keep going:

Set small goals. Like saving $50 this month.

Celebrate little wins. Saved $10? That’s awesome!

Frugal living isn’t about being cheap. It’s about being smart.

If you start small and stay steady, you’ll see results.

What has been your biggest challenge with frugal living or budgeting? Tell us in the comments!

Remember, learning how to make a monthly budget for beginners is the first step. You’ve got this!

Most importantly, remind yourself why you started. It could be for a new phone, a trip, or peace of mind.