Learning how to make a monthly budget for beginners can help you take control and feel less stressed.

A budget is just a simple plan for your money. It helps you know what’s coming in and what’s going out. With a good budget, you can save for fun, pay for essential things, and avoid running out of cash.

In this guide, you’ll learn how to make a monthly budget step by step. Don’t worry—it’s easy, and you don’t need to be a math whiz.

Want to know the first thing most people forget when making a budget? Keep reading and find out!

Why Budgeting Matters for Beginners

What is a Monthly Budget, and Why Do You Need One?

A monthly budget is a plan for your money. It helps you see how much money you get and how much you spend every month. Writing down your monthly income and expenses makes it easier to control your money.

If you are new to budgeting, using a beginner budget worksheet can simplify this. Having a budget stops you from spending too much and helps you save.

Benefits of Creating a Personal Budget from the Start

Making a budget from the start can help you in many ways:

- You learn how to save money every month.

- You can pay your bills on time.

- It lowers money worries.

- You can reach goals, like buying something special or saving for a trip.

I used a step-by-step budgeting guide last year. I tracked my monthly expenses and saw I was spending a lot on snacks. Changing that helped me save $100 every month!

Common Mistakes Beginners Make in Budgeting

Here are some mistakes beginners often make:

- Not writing down all expenses.

- Trying budgeting methods that are too hard.

- Forgetting to split money into easy budget categories like food and fun.

- Not checking their budget often.

To do well, keep your money plans simple. Update your budget every month.

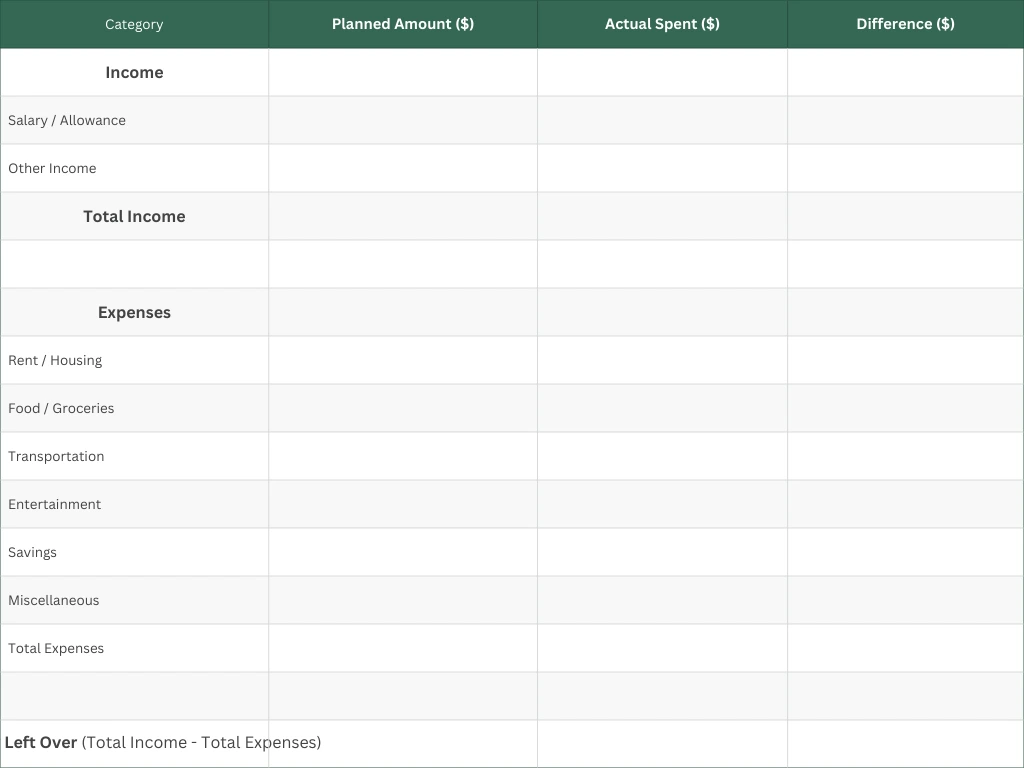

Monthly Budget Worksheet (Simple Version)

Easy Tips to Fill This Out

- Start with your income: Write down how much money you get from this month’s sources.

- Plan your expenses: Think about things you need to pay for, like food, travel, and fun stuff.

- Track your spending: Write down your spending to see if you stay on track.

- Check the difference: If you spent less than planned, great! If more, see where you can cut back.

- Update each month: Your budget will get better as you practice.

Step 1 – Calculate Your Total Monthly Income

How to Identify All Sources of Income

The first step in starting any beginner budget worksheet is knowing exactly how much money you bring in each month. Monthly income and expenses are the foundation of a good budget plan.

Identify your primary income sources:

- Salary or wages after tax

- Side hustles or freelance earnings

- Rental income

- Government benefits or support

- Passive income (like dividends or royalties)

When I began creating a budget plan, I almost forgot to include my weekend freelance writing gigs. Once I added them, I realized I had more flexibility in my budget than I thought.

This helps you get a clear view of your complete financial picture.

What Counts as Income When Budgeting?

Not all income is regular, but you should still count it. This includes cash gifts, bonuses, or one-time payments. If it’s money you can use, it matters.

Simple money management tips:

- Use average amounts if income varies

- Don’t forget part-time or seasonal income

- Track every dollar—small amounts add up

Understanding your full income is the first step in learning how to save money monthly and applying smart budgeting methods for beginners.

Step 2 – Track Your Spending Habits

Why You Should Watch Every Dollar for One Month

If you want to make a smart budget, you need to know where your money goes. That means watching how much you spend each day. Monthly expense tracking is called tracking expenses, and it really helps.

I tried this myself. For one month, I wrote down everything I bought—snacks, games, rides, all of it. I found out I was spending too much on small things. That’s when I learned how to save money monthly by making better choices.

Tracking helps you see:

- What you must pay (like rent or bus fare)

- What you choose to buy (like fast food or clothes)

This step is crucial before you make your whole budget plan. It helps you sort your monthly income and expenses and find the right budget categories for beginners.

Here’s a quick way to start:

- Save your receipts or write down everything you buy

- Use a beginner budget worksheet or notebook

- At the end of the month, look at how you spent your money

When you do this, the following steps become much easier!

Easy Tools to Help You Track Spending

You don’t have to do it all by yourself. These free tools can help:

- Mint – Shows where your money goes

- YNAB – Gives a step-by-step budgeting guide

- EveryDollar – Simple for budgeting methods for beginners

These apps are great for learning how to manage your money. You’ll feel more in control, and that’s a good feeling!

Step 3 – List All Your Fixed and Variable Expenses

What Are Fixed and Variable Expenses?

Let’s break it down.

Fixed expenses are things you pay the same amount for every month. They don’t change.

Variable expenses are things that can change each month. Some months, you spend more. Some months, you spend less.

Understanding both is super important. It helps you see where your money goes. And that’s a big part of learning how to save money monthly.

Examples to Make It Easy

Here’s a quick look at what these two types of expenses might include:

Fixed Expenses:

- Rent or house payment

- Car payment

- Internet or phone bill

- Netflix or other subscriptions

Variable Expenses:

- Groceries

- Gas

- Eating out

- Clothes or fun stuff

When I made my first beginner budget worksheet, I forgot to add things like snacks and soda. I thought they were small, but they added up fast! After tracking them, I started saving more.

Quick Tip

Try using a table or a budget app. List your monthly income and expenses. It helps you see the whole picture fast.

Step 4 – Set Financial Goals That Fit Your Lifestyle

How to Create Short-Term and Long-Term Budget Goals

Setting money goals is a smart way to start your budget. It helps you know why you’re saving and spending. There are two kinds of goals: short-term and long-term.

Short-term goals are things you want soon. Like saving for a new backpack or birthday gift.

Long-term goals take more time. Like buying a laptop or saving for college.

Here’s how to start:

- Think about what you want now and later.

- Write down small goals. Don’t just say, “Save money.” Try “Save $50 in 2 months.”

- Use a beginner budget worksheet to keep track.

- Check your goals every month with a monthly expense tracking chart.

Last year, I wanted to buy a new bike. I saved $20 weekly, and after three months, I had enough money. I used a simple chart to track my progress. It really helped!

Aligning Your Budget with Your Personal Finance Vision

Your budget should match what matters to you. Do you want to travel? Buy cool stuff? Help your family? That’s your personal finance vision.

Here’s what to do:

- Pick what’s most important to you.

- Choose budget categories like “needs,” “wants,” and “savings.”

- Use simple money management tips like: spend less than you earn.

Quick Goal Tracker

This makes it easier to follow a step-by-step budgeting guide and learn how to save money monthly. Small steps add up fast!

Step 5 – Build Your Budget Plan Using a Simple Method

What Budgeting Method Works Best for Beginners? (50/30/20 Rule, Zero-Based Budget, etc.)

If you’re new to budgeting, start with something simple. One easy way is called the 50/30/20 Rule.

Here’s how it works: use 50% of your money for things you need. This means stuff like food, bills, or rent.

Next, use 30% for things you want. That could be going to the movies, buying snacks, or fun activities.

Finally, save 20% of your money or use it to pay off any debts.

This method is easy to understand and helps you keep track of your money without confusion. It’s like a simple guide to make sure you don’t spend too much and still save for the future.

Another way is the zero-based budget. Here, you plan where every dollar goes before the month starts. So, your income minus your expenses equals zero. It sounds tricky, but it works well if you like keeping track of every penny.

When I started budgeting, I tried the 50/30/20 Rule. It helped me see where my money was going and made saving easier. You can try it too!

How to Choose a Budget Format That Works for You (Spreadsheet, App, Paper)

After you pick your method, choose how you want to write your budget. Some people like using a spreadsheet or a simple beginner budget worksheet. It’s a neat way to list your money coming in and going out.

Others use phone apps. Apps can track your spending for you and send reminders. If you like writing things down, just use paper and a pen. This is great for simple money management tips and helps you focus.

Here’s a quick tip:

- Use a spreadsheet if you want to see your monthly income and expenses clearly.

- Use an app if you want help tracking your money.

- Use paper if you like writing things by hand.

You can even make a simple chart to see your money plan at a glance. Picking the right way to keep your budget helps you stay on track and makes managing money less stressful.

Step 6 – Adjust Your Spending to Stay Within Budget

How to Cut Unnecessary Expenses Without Feeling Deprived

Saving money doesn’t mean you have to stop having fun. It just means you make more intelligent choices with how you spend.

First, write down how much money you get each month. Then, write down what you spend it on. A beginner budget worksheet can help. It makes everything easier to see.

Now, review your list and ask yourself, “What do I really need?”

Some things might not be as important as you think. Here are a few examples:

- Buying snacks every day

- Subscriptions you don’t use

- Paying for a fancy phone plan

- Shopping online just because you’re bored

You don’t have to stop everything. Just pick one or two things to spend less on.

Here’s what worked for me:

I used to spend over $100 each month on fast food and coffee. Once I started tracking my expenses monthly, I made coffee at home and packed lunch. I saved about $90 a month. That felt great!

That way, you can still enjoy life—and save money at the same time!

Take a look at this simpleTable:

Making small changes can save big money. You still enjoy life—you spend smarter.

What to Do If Your Budget Isn’t Working

If your budget feels too hard, that’s okay. Try again.

Use a step-by-step budgeting guide to check your plan. Ask yourself:

- Did I forget any bills?

- Are my budget categories too tight?

- Can I change anything?

A reasonable budget should fit your real life. Keep trying until it feels right. You’ve got this!

Step 7 – Review and Update Your Budget Monthly

Why Budget Reviews Help You Stay on Track

Reviewing your budget each month helps you stay in control of your money. It’s easy to overspend when you don’t keep track. A monthly review shows what worked, what didn’t, and where you need to adjust. It’s one of the most simple money management tips you can follow as a beginner.

I noticed my monthly income and expenses didn’t match during December because of holiday spending. A quick review helped me cut back on dining out the next month.

Monthly reviews help you:

- Catch overspending early

- Adjust for unexpected costs

- Improve your budgeting methods for beginners

- Track your savings goals

Using a beginner budget worksheet or a free budgeting apps can make this easier. Most apps now show a clear chart of budget categories for beginners, such as groceries, rent, and transportation.

How to Adjust Your Budget Over Time

As your lifestyle changes, your budget should too. For example, update your spending plan if your income increases or you pay off a loan. This helps improve your monthly expense tracking.

To adjust your budget:

- Recalculate your income

- Review fixed and variable expenses

- Add or remove budget categories

- Use this step-by-step budgeting guide to help you

If you use a budget plan regularly, you’ll find more ways to save money monthly without feeling restricted.

Visual Tip: Create a simple monthly chart comparing your planned vs. actual expenses. This gives a clear picture of where to make changes next month.

Additional Budgeting Tips for Beginners

Emergency Funds and Savings: Where Do They Fit In?

Saving money monthly is easier when you include emergency funds in your beginner budget worksheet. Think of it like a safety net. Life is full of surprises—medical bills, car repairs, or job loss. That’s why it’s essential to plan for unexpected costs.

Start small:

- Save at least $25–$50 each month

- Set up automatic transfers to a savings account

- Use a jar or envelope if you prefer cash

When I started tracking my monthly income and expenses, I saved $30 each month in a separate account. After six months, I had a $180 cushion for emergencies.

Adding an emergency fund is a basic part of creating a budget plan. It builds confidence and reduces stress.

How to Stay Motivated and Consistent with Your Budget

Sticking to a monthly budget can be hard, especially if you’re new. Here’s how to stay on track:

- Set small, clear goals (like “Save $100 this month”)

- Use budgeting methods for beginners, like the 50/30/20 rule

- Celebrate small wins with a low-cost treat

Track your progress using a step-by-step budgeting guide. Using a monthly expense tracking app helped me feel in control.

When you see your progress, you’ll stay motivated. Consistency is key in money management.

Can You Budget on a Low Income? Yes, Here’s How

Yes, you can budget even on a small paycheck. First, list your monthly income and expenses. Then, cut costs in non-essential areas.

Simple money management tips for low-income:

- Cook at home instead of eating out

- Cancel unused subscriptions

- Use public transport to save on gas

Even with a tight income, budgeting helps you control spending and reach your goals.

Conclusion

You don’t have to worry about how to make a monthly budget if you are a beginner. We covered seven easy steps that guide you from tracking income to adjusting expenses. These steps can help you take control of your money, reduce stress, and start saving for what matters most.

The best advice? Start simple. Use a notebook, spreadsheet, or free app—whatever feels easiest. Then, stay consistent. Review your budget every week or month to stay on track. Keep learning about ways to save, cut costs, or earn more as you go.

How to make a monthly budget for beginners is not just about numbers—it’s about building a habit. The more you stick with it, the more confident you’ll feel with your money.

What has been your biggest challenge with creating your first budget? Share your experience in the comments—we’d love to hear from you and help!

Want more beginner-friendly tips? Bookmark this guide and come back whenever you need a refresher.